Thursday, April 06, 2006

FPM Home Loan Planner R1.0

FPM Home Loan Planner R1.0 contains a home loan calculator and a home loan repayment planner.

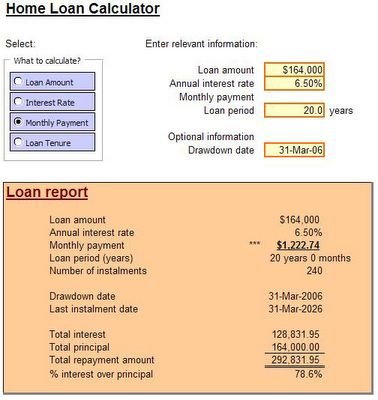

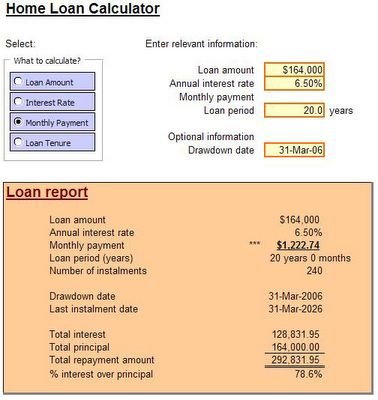

Home Loan Calculator

There are four variables in calculating home loan, i.e. loan amount, interest rate, monthly instalment and loan tenure. The usual home loan calculators found in the internet calculate only the monthly instalment in which users enter loan amount, interest rate and loan tenure. Under certain circumstances, i.e. exploring alternative loan tenure by changing instalment amount, such home loan calculators are cumbersome for use.

In FPM's Home Loan Calculator, users can decide what to calculate by providing data of any three variables.

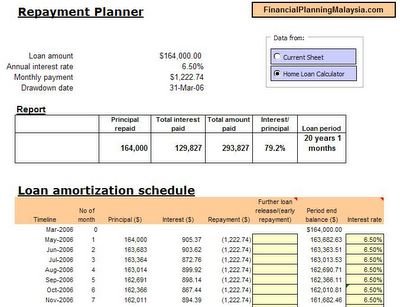

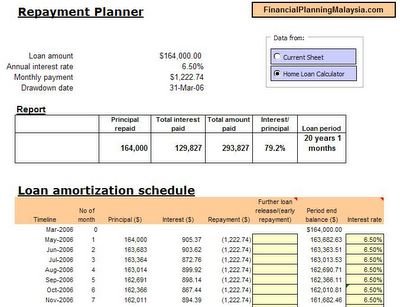

Home Loan Reapayment Planner

The repayment planner contains amortization schedule and provides flexibility of calculation for staggered release of loan (housing project under development) and early repayment of home loan.

Some banks offer lower interest at the begining of the loan. Interest rate can be changed through out the period of the home loan.

Note 1: You can enter early repayment amount and interest rate in the respective columns.

Download FPM's Home Loan Planner here.

Home Loan Calculator

There are four variables in calculating home loan, i.e. loan amount, interest rate, monthly instalment and loan tenure. The usual home loan calculators found in the internet calculate only the monthly instalment in which users enter loan amount, interest rate and loan tenure. Under certain circumstances, i.e. exploring alternative loan tenure by changing instalment amount, such home loan calculators are cumbersome for use.

In FPM's Home Loan Calculator, users can decide what to calculate by providing data of any three variables.

Home Loan Reapayment Planner

The repayment planner contains amortization schedule and provides flexibility of calculation for staggered release of loan (housing project under development) and early repayment of home loan.

Some banks offer lower interest at the begining of the loan. Interest rate can be changed through out the period of the home loan.

Note 1: You can enter early repayment amount and interest rate in the respective columns.

Download FPM's Home Loan Planner here.

Sunday, January 22, 2006

Repaying home loan early?

Among various types of financing, home loan is the cheapest. Why would we want to repay it early? It is cheap financing! The "saving" from the lower monthly instalments could be used, for example, for business, renovations, investing, etc.

This is the logic that most people use to convince themselves not to pay down their home loan. "Well, personal loan is more expensive then home loan..." This is the argument.

In fact they are right...only if their assumption of continuous income stand. In another words, the arguement is only logical if there is no risk of losing your job!

After the 1997 Asia financial crisis, the financial institution that I worked for went through several major and minor corporate restructurings. I was lucky enough to be one of the survivors. However, going through the process of restructuring was not emotionally easy. I was constantly guessing whether I was in the list to go and constantly counting my financial commitments, i.e. home loan. No matter how cheap a home loan is when you have no income to make your repayment you are risking the shelter of your family.

Seeing your colleagues being retrenched at their late thirty or forthy was depressing.

Today, after the announcement of merger of the company I am currently working for, I could almost see the looming of business process rationalization. It is still not easy. But this round, I know my family will have roof above our heads.

It is clever to think that home loan is cheap financing for many other activities in life...too clever to realise sometime tomorrow is not totally in our control. The best risk management practice is to pay off your home loan as early as possible.

This is the logic that most people use to convince themselves not to pay down their home loan. "Well, personal loan is more expensive then home loan..." This is the argument.

In fact they are right...only if their assumption of continuous income stand. In another words, the arguement is only logical if there is no risk of losing your job!

After the 1997 Asia financial crisis, the financial institution that I worked for went through several major and minor corporate restructurings. I was lucky enough to be one of the survivors. However, going through the process of restructuring was not emotionally easy. I was constantly guessing whether I was in the list to go and constantly counting my financial commitments, i.e. home loan. No matter how cheap a home loan is when you have no income to make your repayment you are risking the shelter of your family.

Seeing your colleagues being retrenched at their late thirty or forthy was depressing.

Today, after the announcement of merger of the company I am currently working for, I could almost see the looming of business process rationalization. It is still not easy. But this round, I know my family will have roof above our heads.

It is clever to think that home loan is cheap financing for many other activities in life...too clever to realise sometime tomorrow is not totally in our control. The best risk management practice is to pay off your home loan as early as possible.

Tuesday, October 04, 2005

Repaying home loan

We bought our first home and took up a RM164,000 home loan in the midst of Asia Financial Crisis, 1998. The interest rate then was about 11.64%. Based on the original plan it would take us 20 years to finish off the loan. The total repayment amount would be RM429,359, i.e. RM164,000 principal and RM265,359 interest!!

This is how we repay our 20-year home loan in 7 years.

Check out the actual numbers from the Excel file attached. The first, second and third sheets are our original home loan plan, the actual repayment and the comparison. The fourth sheet is the Home Loan Repayment Planner for you to model your repayment plan.

For our FPM's Home Loan Planner, a more complete home loan calculator and repayment planner compounding monthly, check out here.

Let us know what you think and how we can improve the Planner. Just leave your comments below.

This is how we repay our 20-year home loan in 7 years.

- On the third year of the home loan we made a RM10,000 repayment. Should the interest rate not move in our favour and remained at 11.64%, such repayment would cause an interest savings of RM52,040, equivalent to a reduction of three years of repayment period.

- On the seventh year, we took out our EPF/ KWSP's second account to repay the home loan. Should the interest rate not move in our favour and remained at 11.64%, such repayment would cause an interest savings of RM80,258, equivalent to a reduction of seven years of repayment period.

- The economy indeed moved in our favour. The interest rate dropped from 11.64% to about 6.40%. With this, we saved further RM62,507 interest expenses or a reduction of three years of repayment period.

Check out the actual numbers from the Excel file attached. The first, second and third sheets are our original home loan plan, the actual repayment and the comparison. The fourth sheet is the Home Loan Repayment Planner for you to model your repayment plan.

For our FPM's Home Loan Planner, a more complete home loan calculator and repayment planner compounding monthly, check out here.

Let us know what you think and how we can improve the Planner. Just leave your comments below.

Friday, September 09, 2005

Getting a Home Loan: The Process

These are the steps of getting a home loan.1. Before anything else, get your credit reports from The Credit Bureau, Bank Negara Malaysia. Find out what the banks read about your credit records. It should take about a month for you to get your credit report from the date of your request. A good credit records is helpful in getting a cheaper for home loan.

2. Identify your property.

3. Explore more sources of financing for your home loan, i.e. banks, insurance companies, Building Society, KWSP/ EPF, etc.

4. Make a decision on the type of home loan that fits you, i.e. flexible repayment, low rate fixed term, Islamic, etc.

5. Submit application to the financier of the home loan. The financier will evaluate your eligibility and ability to repay in accordance to its own guidelines. Get your letter of offer. Negotiate a low interest rate if you have a good credit records and are buying a house at a good location built by a reputable developer.

6. Once agreed on the S&P, signed and pay down payment. Depending on situation, you may need to sign the S&P first before your can get your letter of offer from bank. ?(check with CLH)

7. Sign and submit the following documents to your home loan financier.

a. letter of offer

b. S&P agreement

c. valuation reports (if required)

You will have to wait for your lawyer to complete the remaining steps until disbursement of your home loan from your financier.

i. Your home loan financier will verify the documents and instruct lawyer to prepare documents and to check title of property

ii Lawyer to obtain undertakings of various parties

iii. Get signatures from you and the bank officers on ??

iv. Submit documents to land office or high court for registration, stamp office for stamping of home loan

v. Submit registered documents/ title to financier (original) and you (copy)